Planning for their children’s financial future is very important to all parents; for families with special needs children, it can involve more complex and emotional decisions. The cost of supporting a special needs child can be more than double the cost of raising a child without special needs. However, some relief may be available to support families to meet their child’s needs. Here are some tips from an investment advisor on how to access those.

While there are many challenges to support your child, the financial aspect can seem daunting to your family. The need to pay for therapies, medical equipment, special programs, along with a parent’s lost income due to time commitments, makes up a large portion of this added cost. If you have a child with special needs, the path to creating a plan to financially support them can be a challenging one that may require the experience and expertise of a financial professional.

As part of your planning, you may wish to learn about help that may be available to you through tax credits, savings vehicles and government programs that support families to meet their child’s needs.

Tax credits may be available

Starting out, families should obtain approval from the Canada Revenue Agency (CRA) to receive the Disability Tax Credit (DTC). This process requires that a medical professional sign off on a government form to establish the child’s eligibility. The DTC provides the parents of a special needs child a transferable credit on their taxes of about $13,000 (in 2018 and assuming child is < 18 years old).

Oftentimes, families may be eligible for the DTC and not even know it. Families may typically associate the DTC with an individual with a visible disability, when in fact, the DTC covers both visible and non-visible medical conditions. For instance, families with loved ones with the following medical conditions may qualify for the DTC: Autism, Cerebral Palsy, Diabetes (Type 1), Down Syndrome. While this list of medical conditions is not exhaustive, the ultimate decision made by CRA will be dependent upon the opinion of a qualified medical professional, on a case-by-case basis.

The tax credit gives access to matching programs

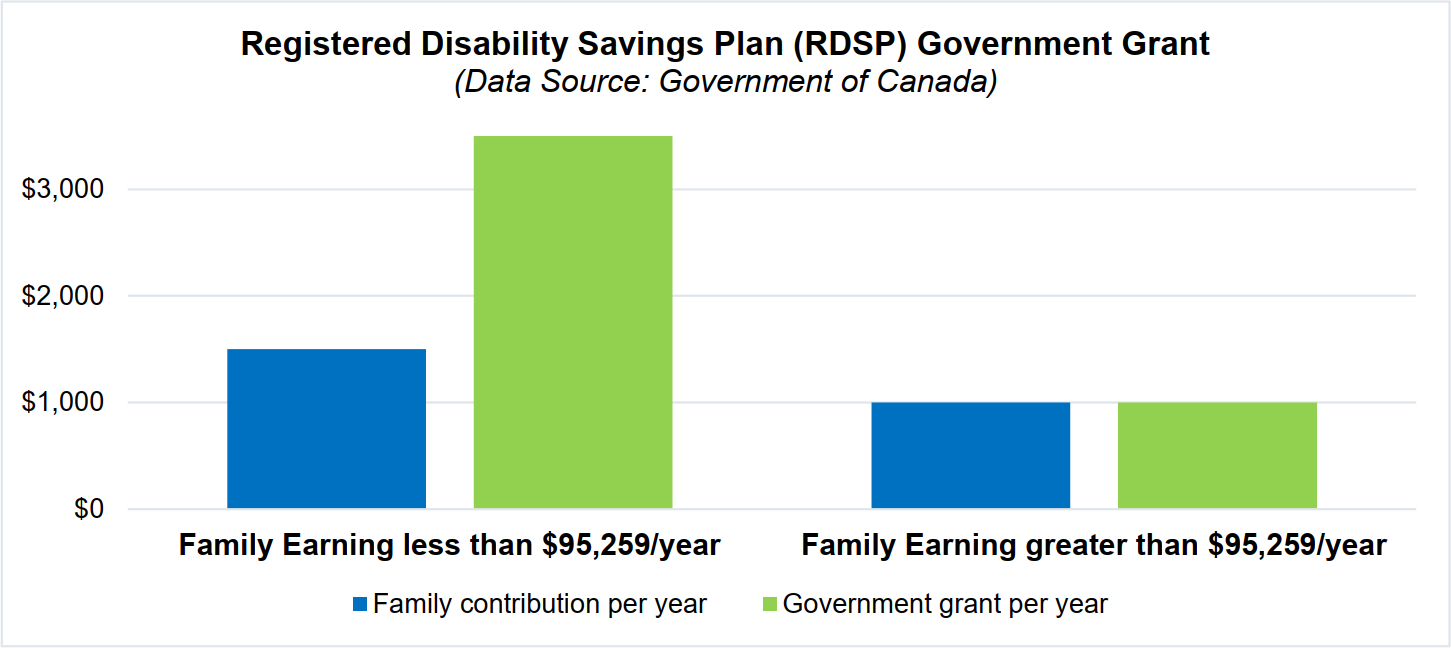

In addition, the DTC allows the family to open a Registered Disability Savings Plan (RDSP). The RDSP provides access to government matching grant and bonds, similar to a Registered Education Savings Plan (RESP). Focusing on the government grant, a family’s contribution to an RDSP of $1,000 a year will be matched by a minimum of $1,000. Also, the family’s contributions along with government bond and grant can be invested in a tax-deferred manner, similar to a Tax-Free Savings Account (TFSA). Combined with government incentives, this tax deferral creates the opportunity for the family to build retirement income for their child’s future to offset lifestyle and support expenses.

Government support programs can also include provincial government support. For Ontario residents, this can include the Ontario Disability Support Program (ODSP). The ODSP is accessible once the child reaches the age of 18. The ODSP is a monthly benefit between $1,000 to $2,000 per month depending on the individual’s circumstances, plus medical, dental, vision, education and job training support. The benefit is paid directly to the special needs individual to cover living expenses.

Estate planning is a must

It is critical for parents of special needs children to update their Will and Power of Attorney (POA) documents. Doing this will ensure proper guardianship of their child when they pass away or are unable to care for them. From a financial perspective, there are many opportunities in your estate plan to ensure that your child is provided for. One of the more common and powerful strategies is combining life insurance on the lives of the parents with a Henson Trust in the parents’ Will.

Navigating the details of these programs and plans can be challenging. Despite the complexity, it is important for families to have a plan and to reach out for professional support. Doing so will ensure the family has access to the financial support and peace of mind they require, so they can focus their time and attention on their children.

Links of interest

- Disability Tax Credit Application Form (medical professional required to complete)

- ODSP

- Henson Trust

Disclaimer:

BUSINESS MATTERS deals with a number of complex issues in a concise manner; it is recommended that accounting, legal or other appropriate professional advice should be sought before acting upon any of the information contained therein.

Although every reasonable effort has been made to ensure the accuracy of the information contained in this letter, no individual or organization involved in either the preparation or distribution of this letter accepts any contractual, tortious, or any other form of liability for its contents or for any consequences arising from its use.

BUSINESS MATTERS is prepared bimonthly by the Chartered Professional Accountants of Canada for the clients of its members.