Dying is not a popular topic of discussion, for obvious reasons, but it is a reality of life. However, planning ahead for your estate could prove to be very rewarding, as it would provide both you and your loved ones with added security and peace of mind.

Minimizing taxes

While you are still working and collecting an income, a typical strategy you might employ is tax minimization, with a focus on reducing annual income tax bills. With estate planning, the theme of tax reduction should remain the same, with the only difference being that the beneficiary of the tax savings will change from yourself to your selected beneficiaries.

Choosing beneficiaries

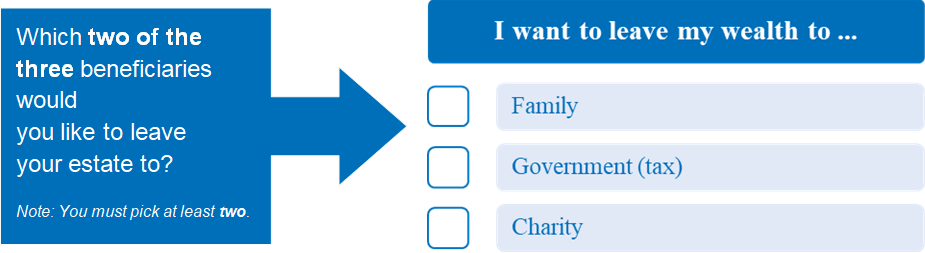

Many clients don’t realize that they have a choice of three beneficiaries to their wealth:

- family

- government (tax)

- charity

When a person dies, the default beneficiaries selected for them are family and government. However, people typically prefer to bequeath their wealth to family and charity, which requires proper estate planning. There are many tax-efficient ways to achieve this desired estate allocation, but they all require forward-planning while the individual is still alive.

Tax minimization strategies

The following strategies, when properly planned for ahead of time, can ensure that your family and preferred charity are the recipients of your wealth when you pass away:

- bequest in will

- gift of publicly traded securities

- registered account beneficiary designation

- life insurance beneficiary designation

The simplest approach is often to update your will and/or registered account beneficiaries. Making a charity a beneficiary in your will requires that you coordinate these details with your legal professional. On the other hand, designating a charity as a beneficiary to your Registered Retirement Savings Plan (RRSP) or Registered Retirement Income Fund (RRIF) requires that you coordinate with your financial institution.

The newest option for tax-efficient charitable giving is a gift of publicly traded securities to a registered charity. When a person dies, the estate may opt to avoid the tax on the capital gains on the deemed-to-be-disposed-of appreciated securities, while still receiving a tax receipt for the full market value of the contribution. Lastly, by using the powerful multiplication effect of tax-exempt life insurance, a significant gift can be created for charity while reducing or eliminating estate taxes. In addition, life insurance can have the added benefit of reducing annual income taxes while you are still alive, as premiums paid where the beneficiary of the policy is a registered charity are eligible for a tax credit.

Creating an estate plan that designates beneficiaries for registered accounts and life insurance has the added benefit of reducing or eliminating probate and estate administration costs. As a result, the estate may be settled faster and more assets may be retained in your estate, allowing greater wealth to be distributed to your loved ones and preferred charity.

Disclaimer:

BUSINESS MATTERS deals with a number of complex issues in a concise manner; it is recommended that accounting, legal or other appropriate professional advice should be sought before acting upon any of the information contained therein.

Although every reasonable effort has been made to ensure the accuracy of the information contained in this letter, no individual or organization involved in either the preparation or distribution of this letter accepts any contractual, tortious, or any other form of liability for its contents or for any consequences arising from its use.

BUSINESS MATTERS is prepared bimonthly by the Chartered Professional Accountants of Canada for the clients of its members.